Bitcoin is up big-time in the past six weeks: per CryptoSlate market data, the leading cryptocurrency has appreciated by 70 percent. This makes it the world’s best performing macro asset class.

Some see this rapid appreciation as a clear sign that Bitcoin will soon see a correction. But, according to a volatility analysis by a fund manager in the space, the truly volatile portion of this rally hasn’t even started yet.

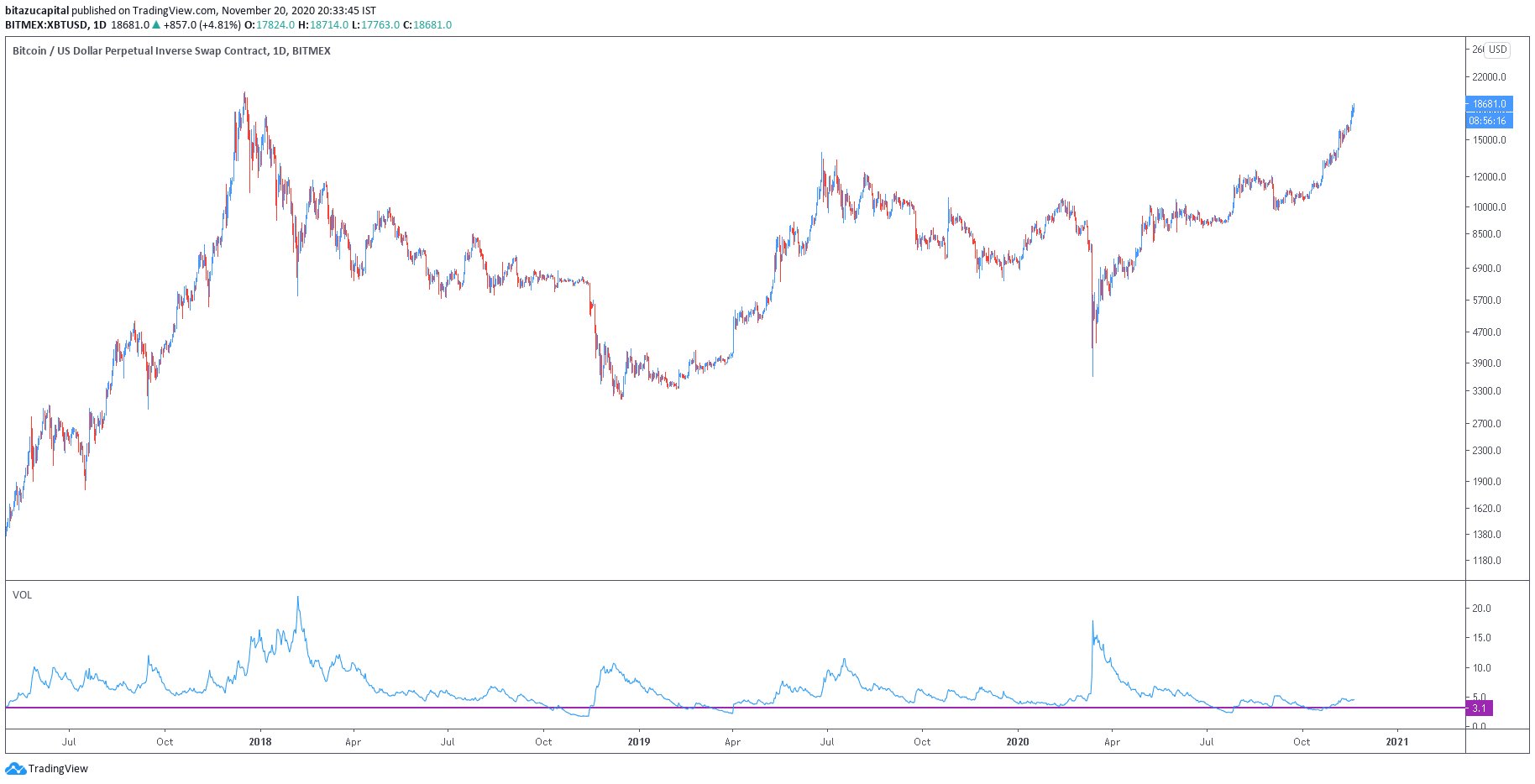

Bitcoin volatility isn’t anywhere close to where it was in 2017

Bitcoin has basically gone parabolic over the past two months.

But as can be seen, this rally has not been punctuated by the sharp rallies and drops of previous bull markets.

Founding partner at Bitazu Capital, Mohit Sorout, recently shared the chart seen below: it shows that Bitcoin’s historical volatility index is currently close to multi-year lows despite the coin gaining 70 percent in six weeks.

If we expect volatility to eventually increase back toward the levels seen in previous market cycles, it is fair to say that the true exponential portion of this rally has yet to start.

Low volatility is here to stay?

Trader “Z” recently postulated in an article for FTX that the low volatility may be here to stay as a result of movements in the cryptocurrency derivatives market.

He wrote that firstly, there has been a large outflow of BTC from exchanges while few BTC from personal accounts are being sent to exchanges, decreasing the amount of selling pressure that could mark strong downtrends in bull markets.

Z added that the introduction of high-frequency traders and other prop trading desks has resulted in dampened volatility:

“BitMEX also saw a flurry of prop trading desks enter the space looking to maximize spread trading and market making on inefficient order books. What was once a common occurrence of seeing perpetual swap funding rates exceed 5 basis points per 8-hour period, today seldom break above the baseline of 1 basis point. Market-makers had taken control of the market and converged the spreads to oblivion, further dampening volatility [could add “and offer traders more efficient pricing”, they aren’t all bad.”

Not to mention, BitMEX’s loss of market dominance has resulted in changes to how many traders actually work in the space.

BitMEX operates on a BTC-margined model, meaning that to open contracts to long Bitcoin, you need BTC. Other exchanges such as ByBit mostly use a USDT-margined model.

The way that BitMEX’s products are structured dramatically increases volatility in downtrends due to the fact that you need to post more in collateral than USDT contracts. This incentivizes recursive price action in the downward price action, as we saw in March of this year.

With other exchanges taking much of BitMEX’s market share, this may also be why volatility is low.

The post Bitcoin’s true rally hasn’t even started yet, volatility analysis shows appeared first on CryptoSlate.

Leave a Reply