Earlier this month, Yearn.finance (YFI) founder Andre Cronje began testing one of his latest projects. This project was Keep3r Network, a decentralized marketplace where projects can post jobs for users to take in exchange for a fee paid in a new token, KPR. The idea is to outsource tasks, which often means interactions with smart contracts, to users who have time on their hands.

While Cronje made it clear that it was just an experiment, investors bought in any way, with some siphoning in hundreds of thousands of dollars in hopes of catching the “next YFI.” Cronje launched YFI in July, which subsequently surged 1,000,000 percent in the two months that followed.

These coins quickly became worthless as Cronje asserted that this was just an internal test for himself.

But over a week later, on Oct. 28, the developer finally rolled out a beta for the Keep3r Network, along with the official token, also named KPR.

While still in a beta testing phase and no audits have been completed, KPR surged massively.

Andre Cronje’s new Ethereum token surges massively in its first 12 hours

Early on the morning of Oct. 28, Cronje deployed new contracts for the Keep3r Network. He deployed 200,000 tokens from his address to a Uniswap pool, along with 700 Ethereum.

This meant that as of the first trade, one KPR traded for approximately $1.40.

At first, investors were hesitant to buy-in. Would this be an internal test like the previous iterations of the Keep3r Network contracts? Was there a bug in the contracts?

But this changed when the link for this new market began to spread on Twitter and Telegram, along with Cronje’s blog posts regarding this latest iteration of the Keep3r Network.

In the span of 12 hours, KPR surged from $1.40 to highs of $200, for a return of just under 15,000 percent.

In the day after that, KPR has continued its ascent. As of this article’s writing, KPR trades for $300 as per data from CoinGecko. It now has a market capitalization of $60 million.

More experiments to come?

It is likely that more experiments and projects from Cronje are to come.

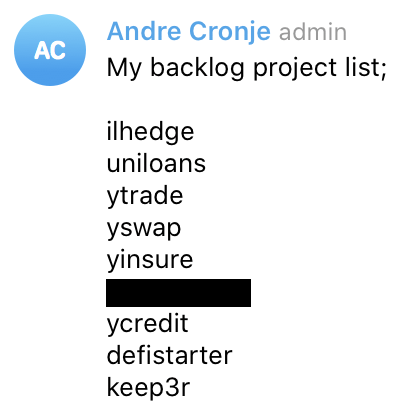

This image below was shared earlier this month. It depicts a message from Cronje in a Yearn.finance developer Telegram group in which he states that he has a backlog of nine projects to work on, all of which involve DeFi in some way.

He is also working on two other projects that aren’t mentioned on that list: Liquidity Basic Income (LBI) and Eminence Finance, both of which have been tested on the Ethereum blockchain over the past month.

The post DeFi dev Andre Cronje’s new Ethereum project surged 15,000% in 12 hours appeared first on CryptoSlate.

Leave a Reply