Ethereum has undergone a remarkable rally over the past seven days.

Per CryptoSlate market data, the cryptocurrency has gained 65 percent in the past seven days and over 100 percent in the past month.

The cryptocurrency’s price action has begun to outpace that of Bitcoin.

According to macro investor Raoul Pal, who is the current CEO of Real Vision and a former Goldman Sachs’ head of hedge fund sales business in Europe, Ethereum is likely to grow even faster in the months ahead. Pal believes that the cryptocurrency is on a similar track to the track Bitcoin was on in 2016 and 2017.

Ethereum is on a similar track to Bitcoin

With Ethereum starting to outpace Bitcoin in this latest leg higher, analysts have begun to ask if there is any credence to the thought process that ETH will outperform BTC in this market cycle.

According to Raoul Pal, this is likely to happen.

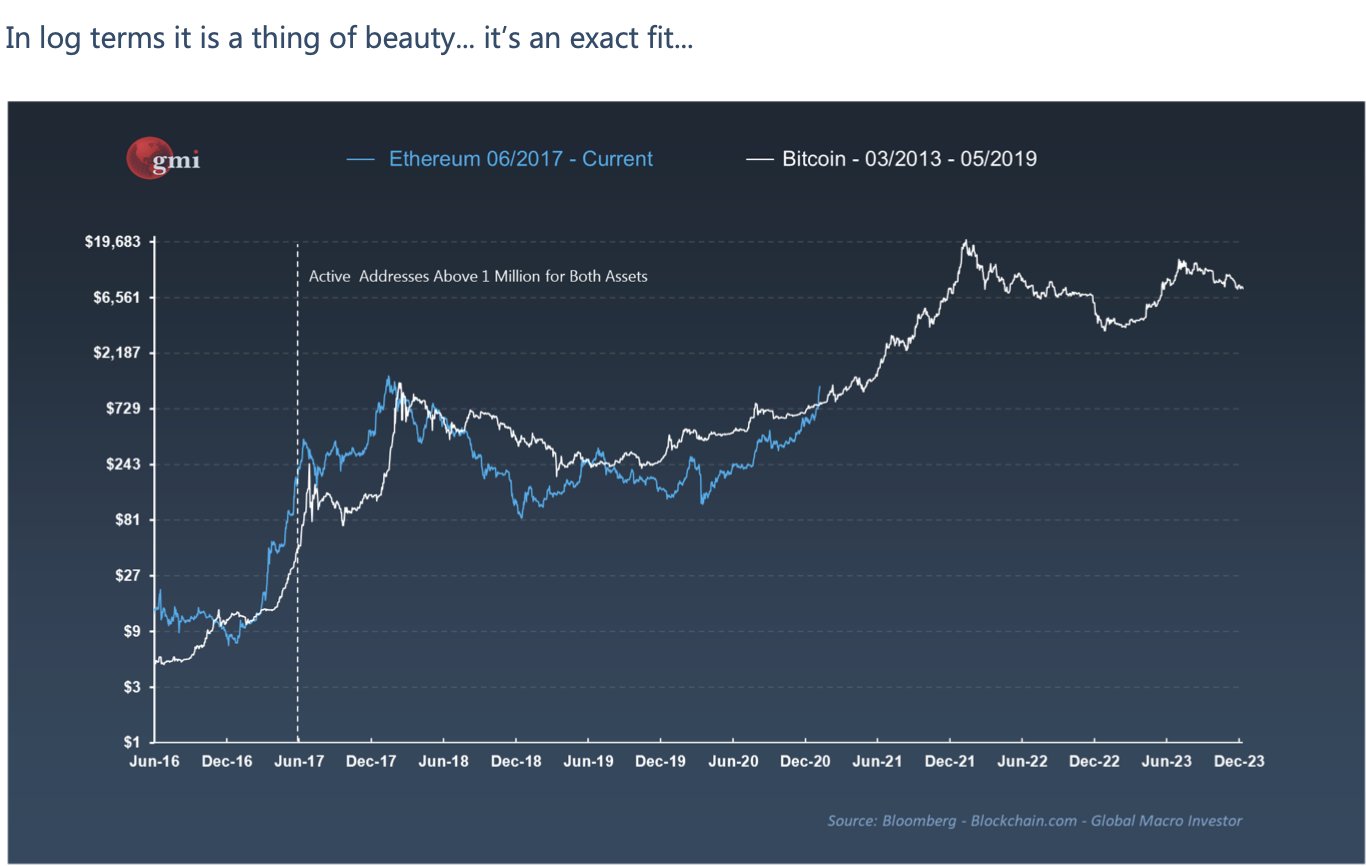

He recently shared the chart below, published to his firm Global Macro Investor, which shows that structurally speaking, Ethereum is likely following the overall trajectory Bitcoin took from 2013 to 2019.

This fractal analysis predicts that in the coming market cycle, Ethereum is likely to gain 2,000 percent, which would give it a price of $20,000. As Pal explained:

“Ooops… ETH looks just like BTC – Metcalfe’s Law seems to be the key to price for both ETH And BTC… Yeah, ETH might well go to $20,000 this cycle… (exact same as BTC last cycle, by market cap ETH will be bigger)”

At a price of $20,000 per coin, Ethereum’s market capitalization would likely surmount that of Bitcoin, assuming BTC only grows by 300-400 percent in this market cycle.

Does this have any credence?

While this prediction alone was based on pure statistics and charts, Pal has noted that there is a fundamental reason to believe that Ethereum will outpace Bitcoin in this market cycle.

As reported by CryptoSlate previously, he explained that while Bitcoin may be the base money or store of value in a future world of fintech, Ethereum is the layer at which transactions settle and where applications are built:

“My hunch is BTC is a perfect collateral layer but ETH might be bigger in market cap terms in 10 years for the reasons above. Money and collateral is just the base layer. Everything builds on top. The store of value is collateral, the trust layer and exchange of value is bigger.”

To translate this into terms from real life, there is estimated to be $19 trillion worth of M2 money in the U.S. today. While this may sound like a lot, there are currently quadrillions of dollars worth of derivatives built on top of this capital base.

Pal thinks that this fact alone could give Ethereum a higher market capitalization than Bitcoin in the years ahead.

The post Macro investor says Ethereum price growth looks similar to Bitcoin’s in 2016-2017 appeared first on CryptoSlate.

Leave a Reply